Why You Should Read Your Travel Insurance Policy Terms & Conditions

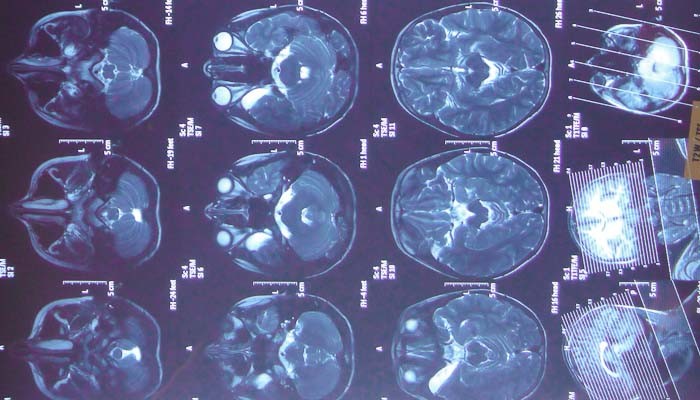

Travel insurance is key to any journey – my son’s broken arm in Mongolia led to evac by helicopter and air ambulance at a cost to our insurers of over $100,000. But it’s also critical that your travel insurance covers what you need it to cover.

And that’s not necessarily as much as you think.

Before you buy any travel insurance, even World Nomads, which we use, set aside an hour or so to read through all the exclusions. There will be many, and some may be deal-breakers.

Where Can You Go?

Most obviously, most travel insurers won’t cover you for places your government advises against travelling to. That’s even the case if it’s listed on their drop-down menu of places they cover. If there’s a current warning from your home government suggesting you don’t travel to an entire country, or to the part of that country, you’ll need to seek out a high-risk insurance specialist to cover you.

What’s the Risk?

Then there’s the risk of the activity. Actuaries spend their working lives calculating risk, and they know the sports and activities that are likely to end up costing a fortune. And – guess what? On cheaper policies, they exclude those activities, to be sure they make a profit.

Very few will cover winter sports – skiing, boarding, snowmobiling – without specifically purchasing that cover. A good insurer will allow you to add this on as an upgrade to your original insurance – so if you’re only skiing one week out of a three-week trip, only buy ski cover for that one week.

Some will only cover activities like trekking or horse-riding if they’re arranged through an operator in your own country, so are covered by the organiser’s insurance, not yours. Many won’t cover treks above a specific height, which could be anything from a humble 3,000m to a rather better 5,000m (World Nomads covers trekking to 6,000m for many nationalities on recognised routes like Everest Base Camp), or dives below a specific depth, usually 30 metres, or activities from mountaineering through to parasailing.

Some of the exclusions are, perhaps, obvious. No one will cover you if you have an accident on the roads while drunk-driving; anything that happens under the influence of drugs is off-limits (and, yes, insurers in many countries do insist on tests for drugs and alcohol the second a victim’s unconscious form arrives at the hospital). Riding a motorbike without a license and/or helmet? Fuhgeddaboudit.

Are You Covered For Worst Case Scenario?s

And then there are the exclusions most of us don’t even think about.

Nobody WANTS to think about their own death, or a travel companion’s death, while travelling – but it does happen. And if your policy doesn’t cover the costs of storing the body, transporting the body and bringing it home, you could, in a worst case scenario, not only be bereaved on a trip but facing a bill of tens of thousands of dollars just to remove the body from storage, and get it on a flight home.

If you’re travelling longterm, you’ll need to check that you fulfil whatever residence requirement the insurer has. Do you spend enough time in the country? Are you on the electoral roll? Are you registered with a doctor? All of these are things your insurance might require you to do – and if not, parents or grandparents may need to sell their home to bring you back.

Are There Local Exclusions?

Even with global insurers like World Nomads, there are differences in price of cover and activities covered between different nationalities. That’s mainly because the underwriters – the people who pay out the money and manage the claim – have different risk profiles in each country, and partly because national laws vary.

Will You Have to Pay Out of Pocket?

Some cheaper insurers offer cover on a reimbursement basis, which means that you pay all your medical costs – which can run into tens or hundreds of thousands – out of pocket and they pay you back later. That’s fine if you’ve got funds in hand, but if you don’t have that kind of cash, look for an insurer that will pay upfront.

Before signing up to any travel insurance policy, it’s critical that you read the whole thing through – word after word, after tedious word. Because you know what? It could save not just your money, but your life.

Please note, I’m a World Nomads affiliate. That means that if you buy their travel insurance through a link on this site (which you can do even while on the road), you’re helping to keep this site running at no cost to yourself.

Image credit: Ernesto still here – a week later! by Corey Balazowich on Flickr’s Creative Commons.